“Bitcoin is an attractive, complicated, new-age currency that exists only online and allows the user to be somewhat anonymous. Bitcoin is the new era of cryptocurrency and its price has grown immensely over the last few years. There’s never been a better time to connect with billion dollars industry!”

Are you thinking of investing in Bitcoin?

This post will summarize some things you need to know before investing in Bitcoin 2018: Step-By-Step Guide for beginners

We’re going to enlighten:

- The basics of investing in Bitcoin

- Why it needs to be taken seriously.

- How to buy Bitcoins (with credit card or bank account)

- How to protect and properly secure your Bitcoins if you have to invest.

Table of Contents

What is Bitcoin?

Bitcoin is a new form of digital currency. It is the first decentralized digital currency, as the system works with no a central bank or single proprietor. Bitcoin is a currency designed to pay for goods and services, just like Euros or U.S. Dollars.

Who created Bitcoin?

Bitcoin was created by the name Satoshi Nakamoto, a software engineer and released as open-source software in 2009.

How does it operate?

Bitcoin uses peer-to-peer technology to operate with no central authority or banks; managing transactions and the issuing of bitcoins is carried out collectively by the network. There are low transaction fees and no need to give your real name.

Bitcoin is open-source; its design is public, nobody owns or controls Bitcoin and everyone can take part. Through many of its unique properties, Bitcoin allows exciting uses that could not be covered by any previous payment system.

- Fast peer-to-peer transactions

- Worldwide payments

- Low processing fees

Who prints Bitcoin currency?

Bitcoin currencies are not printed on paper like Rupees, Euros or Dollars. They are formed by people, and increasingly businesses, running computers all around the world by using software that solves mathematical problems.

Who controls the price of bitcoin?

Bitcoin is not controlled by any central agency. The price of a bitcoin is verified by supply and demand. When demand increases for bitcoins, the price rises, and when demand decreases, the price falls.

How Bitcoin works?

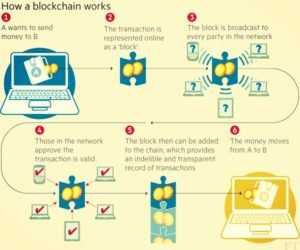

When you send bitcoin to a receiver, the transaction is added in the blockchain and broadcast to the network, the blockchain make sure that the same bitcoin is not spent twice by the same user.

A computer network authorizes the transaction using algorithms so that the transaction becomes unchangeable. After validation, the transaction is added to others to create a block of data for the ledger.

What is Blockchain?

Bitcoins control an open transaction ledger called the ‘Blockchain.’ All transaction data on the network is recorded on the blockchain. Each time a new block is mined the transaction data held inside that block is added to the blockchain and confirmed. The blockchain is then downloaded by every wallet making it irreversible. All information on the network is encrypted to create anonymity, but this still needs more improvement.

Bitcoins control an open transaction ledger called the ‘Blockchain.’ All transaction data on the network is recorded on the blockchain. Each time a new block is mined the transaction data held inside that block is added to the blockchain and confirmed. The blockchain is then downloaded by every wallet making it irreversible. All information on the network is encrypted to create anonymity, but this still needs more improvement.

How are Bitcoins stored?

Bitcoins are stored on wallet which essentially serving as their own bank for the user. A wallet program is offered by the Bitcoin network which allows users to transfer bitcoin between one another. Wallets can be stored in a variety of ways:

- Online wallet provider

- CPU wallet

- Paper wallet

- Mobile wallet device

- Smartphone apps

- In your brain

Bitcoins are stored on the blockchain so they’re essentially like cloud money. You are accessing the rights to them when you exchange them through a wallet or service provider.

How to Buy Bitcoin?

To buy a bitcoin, initially, you need to download a Bitcoin wallet by going to a site such as Blockchain.info or the mobile app like Bitcoin wallet for Android or Blockchain Bitcoin wallet for iOS. Then fill out an online form with all require details which takes more than 2 minutes, here you will create an alphanumerical address, which is like your account number and it is available publicly and it can be used to receive bitcoin and a private key like your bank account password.

After getting a bitcoin, you have to send them to your private digital wallet. The exchanges follow KYC norms like bank accounts.

How to open bitcoin wallet account?

Bitcoin wallets can be downloaded free; it handles all your bitcoin address and also allows you to make payments to others. Few bitcoin wallets force you to cut and paste a bitcoin address while sending bitcoin to it and in few bitcoin; you can scan a bitcoin address if it is displayed as a QR code.

There are various kinds of bitcoin wallet, where some will work only on the desktop computer like your Mac or PC or they may store your bitcoin address and private keys to access them on your hard drive.

Few bitcoin wallets also available in Smartphone versions, you can also use online wallets which services to run of the internet, by storing your wallet there securely.

How to add bitcoin to the wallet?

Bitcoin can be sent to anyone and anywhere in world digitally who have bitcoin address, one person can have many addresses for different reasons like the business, personal etc.

The receiver can spend the coin within minutes after receiving it. Once after giving away, you cannot get back, till the receiver decided to give them to you.

When is the right time to buy?

As with any market, nothing is for sure. All through its record, Bitcoin has normally increased in value at a very fast pace, followed by a slow, steady downfall until it stabilizes. Use tools like Bitcoin Wisdom or Cryptowatch to analyze charts and understand Bitcoin’s price history.

What are the risks of buying or selling Bitcoin?

Bitcoin is not reversed by any central bank or government, or by physical assets. Its value depends on the investment and infrastructure it has taken to create the bitcoin network and, most importantly, it depends on people’s confidence in the digital currency.

The price of Bitcoin is unstable as compared with the most major fiat currencies – that is, its value can rise up or fall moderately over a short period of time. While its price may go upwards in future, like any currency and it could also go down the value. Anyone buying bitcoin should take this into account.

Like any investment, bitcoin creates certain risks. The responsibility is on you, the customer, to research and minimize such risks.

How to Secure Bitcoins

Securing your bitcoins is necessary. If you’re serious about investing in bitcoin, we recommend using Bitcoin wallets that were built with security in mind.

Bitcoins must only be reserved in wallets that you control. Always keep in mind that it is your responsibility to adopt good practices in order to protect your money.

For example: – If you leave $5,000 worth of gold coins with a friend, your friend could easily run off with your coins and you might not see them again.

Bitcoins are selling and buying on the internet. Even, It can be easy to steal and much hard to return and trace. Bitcoin itself is secure, but bitcoins are only as secure as the wallet storing them.

“Investing in bitcoin is no joke, and securing your investment should be your top priority.”

Why are people investing so much money into Bitcoin?

People are investing so much money into Bitcoin because it’s like gold, or more accurately, the gold of the Internet. As long as people have faith that this currency has value and they will continue to invest in Bitcoin. Bitcoin is open-source software. Therefore, it has no central bank or government, or physical assets to control.

“People are not buying into the value of Substance. They are buying into the value of Hype.”- said Warren Edward Buffett, an American business magnate and Investor

5 most important things to know before investing in Bitcoin 2018

-

Extreme volatility

Investing in cryptocurrencies involves very high risk, as prices have been extremely volatile. Many experts are skeptical about bitcoin as an investment primarily because there is nothing for them to analyse.

-

Neither commodity, nor currency

The lack of transparency about its origin is another big issue related to bitcoin.

-

An unregulated space

Unlike other investment avenues, cryptocurrencies are not regulated by government entities or banks.

-

Ponzi schemes abound

Out-of-the-way from the operational issues of trading in cryptocurrencies, there is also a high risk of fraud. There is still a good deal of misinformation and lack of clarity regarding bitcoin trading, and fraudsters have taken advantage of this to launch Ponzi schemes, which promise ‘guaranteed high returns’. A few companies claim to twice the initial investment within a very short period of time. The growing use of virtual currencies in the global marketplace makes it easy for miscreants to lure investors into Ponzi schemes. Investors should be careful to steer clear of such unrealistic promises.

-

Don’t invest if you don’t have any knowledge about Bitcoin.

Final Thoughts

It’s essential to know about all things how Bitcoin works before investing any money. Bitcoin is still new and it can take months to understand the true impact Bitcoin can have on the world. So, you should take your own time to know about Bitcoin, how it works, how to secure bitcoins, and about how Bitcoin differs from fiat money.

The above information should not be in use as investment advice. It is for general knowledge purposes only. You should make your own research before buying any bitcoins.