Table of Contents

What does One-Time Password (OTP) mean?

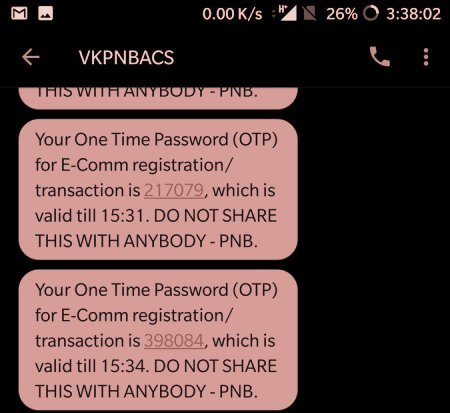

A one-time password (OTP) is a type of password that can be used only once during a short time period. It is valid for only one-time use. The password becomes worthless after it has been used and cannot be used again.

A one-time password (OTP) is a type of password that can be used only once during a short time period. It is valid for only one-time use. The password becomes worthless after it has been used and cannot be used again.

OTP means One Time Password which is randomly generated and sent to your registered mobile number for confirmation of the transaction. It is a secure way to use and provide access to an application or perform a transaction only one time. The OTP will be sent to your registered mobile number within 2 minutes.

How is OTP used?

The full form of OTP is One Time Password, a password that can be used only once. Payment is made after online verification, login, ticket booking, or online shopping. For which the benefit of the home sitting facility is availed. Home sitting facility means payment by Net Banking, Mobile Banking, BHIM, Paytm, Debit Card or Credit Card. What will happen if only ATM Password gets paid? That is why an OTP number is required when making an online payment. It comes on your registered mobile number as an SMS, OTP code 4 to 8 digits also. Users cannot make payments with any account without OTP verification.

What is the use of OTP?

It is a secure way to provide access to an application or perform a transaction only one time. Some website or application user also uses OTP for verification. Often forgets the password of the user account (Gmail, Facebook, Linkedin, and Twitter). To reset it, the link is sent to the email or the OTP is sent in the SMS and reset the password using the OTP sent by the website/application.

The risk of online hacking has increased in the digital era, so OTP is a kind of security. If anyone has the Net Banking ID, the password can be anything but due to OTP, he does not know anything! Whenever someone logs in to Facebook or Gmail, its message also comes.

Your account is safe with OTP. I give you an example of PNB, whenever PNB tries to transact through Net Banking, PNB registers an OTP on mobile, without which transaction is not completed. If the password is detected, even when the account cannot be transacted as it does not have a registered phone.

How is OTP sent?

OTP is sent in three ways.

- SMS OTP is sent by Sms on this registered mobile. Most websites use this, it’s easy and safe.

- Voice Calling OTP is sent on a registered mobile phone. Sometimes when Call is not on time in delivery, Call is done.

- E-mail OTP sends OTP to Registered E-mail Id email. It is used very little in India.

Use the OTP key

Generally, the use of OTP is more in such a situation where the transaction of money or log in to any such online account has much-related information related to the user. Example: Internet Banking, Aadhar Card, Share Cab Booking, Gmail Account 2 Step account verification. Aside from this, the use of OTP is very much in place. The online shopping website uses OTP for the customer’s account security. While creating some websites and application accounts, the user verifies with the help of OTP. Almost all banks use this option while doing online banking.

Conclusion about OTP

After reading this article, you may come to know that what is OTP-One Time Password? It means a password which can be used only once. There is also some validity of OTP. The validity of Bank OTP is about 20 Minutes of approx. If this OTP is used after 20 minutes it becomes invalid. Hacking risks in Digital Era have increased a lot. In such a situation, OTP is a secure option. It should be used. If you use 2 Step Verification in Gmail but what to do if you ever lose a mobile phone. In this way, Gmail gives some code while enabling 2 step verification. This can be used by tax login.