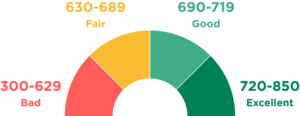

A credit score is a three-digit number that shows your creditworthiness or how likely you are to repay debt. Your credit score determines whether or not you will get money from financial institutions. The credit score ranges from 300-850. If your credit score is close to 300 it means that you have a bad credit score and most probably you are not gonna get a loan, but if your credit score is close to 850 then it will be considered as a good credit score and most probably you will get a loan. A credit score above 750 is considered a good credit score. Many factors determine your credit score but the most important factor is how often you make payments on time.

Most of the New Zealanders don’t pay much attention to there credit score but at a time of medical emergency, your bad credit score could be a big problem.

Why you should pay more attention to your credit score?

- If you have a good credit score, you’ll almost always get a loan.

- At a time of financial emergency, your credit score can save you from a big loss.

- If you have a good credit score you can bargain the best interest rate for yourself.

- Your credit score can save you at a time of medical emergency.

- Better chance of getting a credit card and loan approval.

- You have to pay a low-interest rate on your credit card and loan if you have a good credit score.

- You will get a better insurance rate if your credit score is good.

- The security deposit on utilities will be minimum if you have a good credit score.

How to improve your credit score?

Paying bills on time

This may seem obvious, but most people have a bad credit score because of this factor. Every Financial Institution wants their money on time, so this factor becomes the most important factor that affects your credit score. For most people, it’s very hard to pay their bills on time because they use more credit then they can use, so you should never use more credit than you can pay.

Don’t apply for new credit card

Your credit rating might slowly drop whenever you apply for a new credit account or credit card. Because if you have more credit card you will use more credit and if you use more credit then you will be unable to pay your bills on time and if you can’t pay your bills on time your credit score will drop.

Payoff any outstanding loan or debts

You should never have any outstanding credit card payment or outstanding debts of any kind because no one is going to trust you in terms of cash if you don’t pay your bills for such a tong time that they can be called outstanding.

Keep credit card balance low

A constantly low balance for your credit card shows that you spend your money wisely. If your credit card has a monthly limit of 1,00,000 dollar but you are spending only 35,000 dollars then it shows that you are capable to pay much more then you are spending.

Maintain your credit account

As long as you can maintain your credit account without any negative reports (like missed payment), the more it will improve your credit score.